Public Safety Canada Quarterly Financial Report

For the quarter ended June 30, 2016

Table of Contents

- 1.0 Introduction

- 2.0 Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

- 3.0 Risks and Uncertainty

- 4.0 Significant Changes in Relation to Operations, Programs and Personnel

- 5.0 Approval by Senior Officials

- 6.0 Statement of Authorities (unaudited)

- 7.0 Departmental budgetary expenditures by Standard Object (unaudited)

1.0 Introduction

This quarterly financial report has been prepared by management as required by section 65.1 of the Financial Administration Act, in the form and manner prescribed by the Treasury Board Accounting Standard 1.3. This quarterly financial report should be read in conjunction with the Main Estimates, as well as Canada’s Economic Action Plan 2014 (Budget 2014), Canada’s Economic Action Plan 2015 (Budget 2015) and Growing the Middle Class (Budget 2016).

This quarterly financial report has not been subject to an audit. However, it has been reviewed by the Departmental Audit Committee prior to approval by senior officials.

1.1 Authority, Mandate and Program

Public Safety Canada plays a key role in discharging the Government's fundamental responsibility for the safety and security of its citizens. The Department of Public Safety and Emergency Preparedness Act 2005 and the Emergency Management Act 2007 set out three fundamental roles for the Department: (i) support the Minister's responsibility for all matters related to public safety and emergency management, except those assigned to another federal minister, (ii) exercise national leadership for national security and emergency preparedness; and (iii) coordinate the efforts of Public Safety Portfolio agencies, as well as provide guidance on their strategic priorities.

The Department provides strategic policy advice and support to the Minister of Public Safety and Emergency Preparedness on a range of issues, including: national security, border strategies, countering crime and emergency management. The Department also delivers a number of grant and contribution programs related to emergency management, national security and community safety.

Further information on the mandate, roles, responsibilities and program of Public Safety can be found in the 2016-17 Report on Plans and Priorities and the 2016-17 Main Estimates.

1.2 Basis of Presentation

This quarterly report has been prepared using an expenditure basis of accounting. The accompanying Statement of Authorities includes the Department’s spending authorities granted by Parliament, or received from Treasury Board Central Votes, and those used by the Department consistent with the Main Estimates for the 2016-17 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet the information needs concerning the use of spending authorities.

The authority of Parliament is required before funds can be spent by the Government. Approvals are given in the form of annual limits provided through Appropriation Acts or through legislation in the form of statutory spending authority for specific purposes.

As part of the departmental performance reporting process, Public Safety prepares its annual departmental financial statements on a full accrual basis in accordance with Treasury Board accounting policies, which are based on Canadian generally accepted accounting principles for the public sector. However, the spending authorities voted by Parliament remain on an expenditure basis, as do the expenditures presented in this report.

As part of the Parliamentary business of supply, the Main Estimates must be tabled in Parliament on or before March 1st, preceding the new fiscal year.

1.3 Public Safety Canada Financial Structure

Public Safety has a financial structure composed mainly of voted budgetary authorities that include Vote 1 – Operating Expenditures, Vote Netted Revenues and Vote 5 – Grants and Contributions. The Department’s statutory authorities consist of Contributions to Employee Benefit Plans (EBP) and Minister of Public Safety and Emergency Preparedness – Salary and motor car allowance.

About 86.9 percent of the Department’s budget is devoted to delivering transfer payment programs related to emergency management, national security and community safety. The largest programs include payments made pursuant to the Disaster Financial Assistance Arrangements (DFAA), the First Nations Policing Program (FNPP), the National Crime Prevention Strategy (NCPS) as well as the National Disaster Mitigation Program (NDMP).

2.0 Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

The figures presented in the report are in accordance with the government-wide chart of accounts for Canada for 2016-17 and Treasury Board Accounting Standard 1.3.

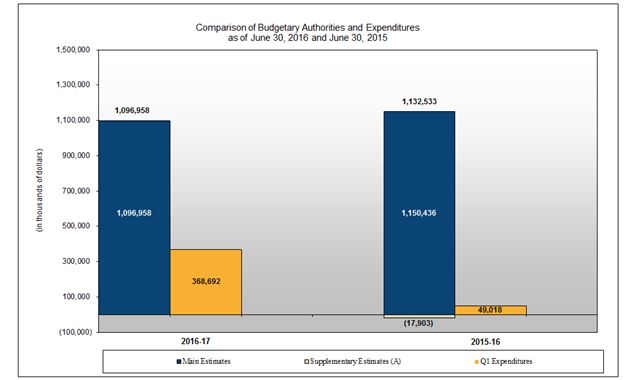

The following graph provides a comparison of the net budgetary authorities and expenditures as of June 30, 2016 and June 30, 2015 for the Department’s combined Vote 1, Vote 5 and Statutory Votes.

Image Description

Budgetary Authorities and Expenditures Comparison

Starting from the left hand side, the “first” column in the graph indicates that the Department authorities are at $1,097.0 million for fiscal year 2016-17. The year-to-date expenditures of $368.7 million reported at the end of the first quarter of the 2016-17 fiscal year are shown under the “second” column. The “third” column in the graph depicts the 2015-16 authorities which were at $1,132.5 million at the end of June 2015. The 2015-16 year-to-date expenditures of $49.0 million are shown under the “fourth” column.

Note: (1) The 2015-16 Supplementary Estimates ‘‘A’’ (SEA) amounted to ($17,903K). The Department’s appropriations have decreased by $41,492K for a transfer to the Royal Canadian Mounted Police for the First Nations Community Policing Service which is offset by increases of $23,589K for other items included in SEA.

2.1 Significant Changes to Authorities

For the period ending June 30, 2016, the authorities provided to the Department included Main Estimates only. The 2015-16 authorities for the same period included Main Estimates and Supplementary Estimates (A). The Statement of Authorities presents a net decrease of $35.5 million (3.1 percent) in Public Safety’s total authorities as at June 30, 2016 compared to those of the same period of the previous year (from $1,132.5 million to $1,097.0 million).

This change in authorities is comprised of an increase in Vote 1 – Operating Expenditures ($10.4 million), a decrease in Vote 5 – Grants and Contributions ($46.9 million) and an increase in Budgetary Statutory Authorities ($1.0 million).

Vote 1 - Operating Expenditures

The Department’s Vote 1 increased by $10.4 million or 8.8 percent, mainly due to:

- An increase of $8.4 million to advance Phase II of Canada’s Cyber Security Strategy, which will introduce actions to secure cyber systems outside of the Government of Canada;

- An increase of $2.9 million for the transfer of control and supervision of the National Search and Rescue Secretariat (NSS) from the Department of National Defence (DND);

- An increase of $0.8 million for funding the National Disaster Mitigation Program announced in Budget 2014, which aims at reducing the impacts of natural disasters on Canadians;

- An increase of $0.4 million in support of Division 9 of the Immigration & Refugee Protection Act, which was internally funded in fiscal year 2015-16.

- A decrease of $1.0 million related to the sunsetting of the Kanishka Project Research Initiative, which supported research on pressing questions for Canada on terrorism and counter-terrorism;

- A decrease of $0.7 million as a result of sunsetting of funding, which is currently under review and may be renewed, to support enhanced national security review under the Investment Canada Act;

- A decrease of $0.2 for funding previously required for the Government of Canada’s provision of federal services to the Toronto 2015 Pan American and Parapan American Games;

- A decrease of $0.1 million for a transfer to Canada’s School of Public Service to support its new funding model; and

- A decrease of $0.1 million for a frozen allotment to support the 2016 Census of Population.

Vote 5 - Grants and Contributions (G&C)

The Department’s Vote 5 decreased by $46.9 million or 4.7 percent, mainly due to:

- A decrease of $158.6 million for non-discretionary requirements to address existing and future obligations under the Disaster Financial Assistance Arrangements program;

- A decrease of $1.5 million related to the sunsetting of the Kanishka Project Research Initiative, which supported research on pressing questions for Canada on terrorism and counter-terrorism;

- An increase of $42.6 million of which $41.5 million is for a transfer made to the Royal Canadian Mounted Police for the First Nations Community Policing Service through the 2015-16 Supplementary Estimates (A) that is not yet reflected in the 2016-17 authorities and $1.1 million is to supplement the First Nations Policing Program, the majority of which is to maintain funding for policing agreements with First Nation and Inuit communities;

- An increase of $38.3 million for financial assistance to the Province of Quebec for decontamination costs following the train derailment and explosion in Lac-Mégantic, Quebec;

- An increase of $21.5 million for the National Disaster Mitigation Program announced in Budget 2014, which aims at reducing the impacts of natural disasters on Canadians;

- An increase of $7.4 million for the transfer of control and supervision of the National Search and Rescue Secretariat (NSS) from the Department of National Defence (DND), offset with transfers to and from other organizations for investments in search and rescue prevention and coordination initiatives across Canada;

- An increase of $2.0 million for the Nation’s Capital Extraordinary Policing Costs Contribution Program, which will reimburse the City of Ottawa for eligible extraordinary, reasonable and justifiable policing costs incurred by the Ottawa Police Service for policing duties specific to the Nation’s Capital; and

- An increase of $1.3 million for funding in support of non-legislative measures to address prostitution.

Budgetary Statutory Authorities

The increase of $1.0 million or 6.5 percent in 2016-17 is mostly related to the Employee Benefit Plan (EBP) costs associated with the change in the Department budgetary requirements for salary and EBP.

2.2 Explanation of Significant Variances from Previous Year Expenditures

Compared to the previous year, the total expenditures in the first quarter, ending June 30, 2016, have increased by $319.7 million, from $49.0 million in 2015-16 to $368.7 million in 2016-17 as per the table of Departmental Budgetary Expenditures by Standard Object. This represents an increase of 652.2 percent against expenditures recorded for the same period in 2015-16.

This increase in spending is mainly composed of an increase in Vote 1 – Operating Expenditures of $4.5 million (from $22.7 million to $27.2 million), and an increase in Vote 5 – Grants and Contributions of $314.9 million (from $22.6 million to $337.5 million).

Personnel expenditures (including expenditures related to EBP and the Minister’s salary and motor car allowance) have increased by $2.5 million over the previous year (from $24.8 million to $27.3 million), due to higher expenditures in regular salaries for continuing employees (increase of $1.4 million) as well as casual, part-time and seasonal employees (increase of $0.8 million), and in EBP (increase of $0.3 million). The increase is mainly attributed to the transfer of the National Search and Rescue Secretariat (NSS) to Public Safety Canada, as well as some short term impacts of the Departmental realignment of functions, which takes into account planned retirements and other attrition as the Department is transitioning to a new structure.

Other operating expenditures have increased by $2.3 million over the previous year (from $2.7 million to $5.0 million), mainly due to prepaid expenses to the Department of Justice Canada ($1.6 million) related to its new funding structure, office space rental ($0.5 million), and IT services ($0.2 million).

Transfer payments expenses increased by $314.9 million in the first quarter of 2016-17 compared to the first quarter of 2015-16 (from $22.6 million to $337.5 million) mainly due to an advance payment to the Province of Alberta to assist with the recovery efforts of the Fort McMurray wildfire ($307.0 million) under the Disaster Financial Assistance Arrangements (DFAA) program, as well as higher expenditures for the First Nations Policing Program (increase of $4.7 million).

Lastly, revenues collected for interdepartmental provision of internal support services, which are netted against expenditures, increased by $0.1 million in the first quarter of 2016-17 compared to the same period of 2015-16.

3.0 Risks and Uncertainty

The Department’s mandate spans from public safety and security, intelligence and national security functions, social interventions for youth-at-risk, to readiness for all manner of emergencies. Public Safety is called, on behalf of the Government of Canada, to rapidly respond to emerging threats and ensure the safety and security of Canadians. The Department’s ability to deliver its programs and services is subject to several risk sources, such as the rapidly changing asymmetrical threat environment, its ability to respond to natural or man-made disasters, government priorities, and government-wide or central agency initiatives. To deliver this mandate effectively, the collaboration of many departments and agencies, provincial and territorial governments, international partners, private sector and first responders is required. Without the collaboration of all these partners, the Department is at risk in the delivery of its mandate and objectives, making the effectiveness of these relationships crucial.

Fiscal Restraint

Public Safety continues to face pressures that have an impact on the Department’s funding base and its flexibility to reallocate funding to achieve expected results.

In recognition of this tightening fiscal environment, Public Safety examined all of its departmental program spending, balancing resource allocations against identified priorities by shifting from lower to higher priorities. The Department continues to explore strategies to mitigate and manage the impact of the changing fiscal environment on the organization. As such, the Department announced in December 2013 a realignment of departmental functions (of note, details on the realignment of departmental functions are found in the Significant Changes in Relation to Operations section).

2013 Operating Budget Freeze

In keeping with the Government’s commitment to implement measures to return to balanced budgets in 2015, Economic Action Plan 2014 (Budget 2014) announced a number of whole-of government initiatives to control the size and cost of government operations.

The November 2013 Update of Economic and Fiscal Projections reintroduced a freeze on departmental operating budgets. This freeze applied for two years beginning in 2014–15. The operating budget freeze was expected to generate government-wide savings of roughly $550 million in 2014–15 and $1.1 billion in 2015–16, by introducing a number of whole-of government initiatives to contain costs and increase efficiencies. One of these initiatives is related to compensation adjustments.

Compensation Adjustment

These savings were mainly managed by requiring organizations to absorb the ongoing impact of wage and salary increases that take effect during the freeze period.

2014-15 marked the beginning of a new round of collective bargaining between the Government of Canada and federal public service bargaining agents. The Government continues to work with these bargaining agents to renew all 27 of its collective agreements.

As the outcome of these negotiations is unsure, Public Safety’s share of the impact has been estimated at $2.1 million. To mitigate this risk, the Department was able to create a Frozen Allotment of $934K from its 2014-15 surpluses and $803K from its 2015-16 surpluses for the 2014-15 and 2015-16 incremental compensation adjustment amounts. These funds will be used to partially finance the retroactive costs of collective agreement renewals.

4.0 Significant Changes in Relation to Operations, Programs and Personnel

4.1 Significant Changes in Relation to Operations

Departmental Realignment

As of July 4, 2016, the majority of executive placements related to the realignment of departmental functions have been carried out.

Implementation of the non-executive realignment is well underway. The latest update indicates that 86 percent of impacted employees had been matched or placed indeterminately in an end state position, had found employment elsewhere, or had plans to retire in the next three years. This is well ahead of schedule. Through branch management committees, the Resource Management Committee (RMC) and the departmental Realignment Committee, options and strategies are reviewed to continue placing the remainder of impacted employees.

As of July 4, 2016, 66 percent of new or vacant end-state positions had been matched with existing employees or staffed. This illustrates the continuing need to recruit new employees within PS, over and above the placement of impacted employees. To address this gap, the Department is running multiple collective staffing processes for various groups and levels.

The RMC continued to act as a forum for departmental consultation and deliberation on the realignment in order to coordinate approaches across the Department, engage with employees and share successful practices. Unions are at the table to discuss concerns raised by their members. The RMC meetings, along with the regular Labour Management Consultation Committee (LMCC) meetings, ensure ongoing communication with the unions, thus enabling the Department to understand and address issues and concerns as they arise.

Phoenix Pay Modernization Project

In April 2016, Public Safety moved to the new Phoenix federal public service pay system, which includes streamlined and modernized business processes and self-service features for employees and managers. Steps were taken to prepare the department for the move, including Phoenix information sessions, new controls for Human Resources (HR) data entry, and streamlined procedures for issuing emergency salary advances. The department also centralized the Trusted Source function within HR and finance, to standardize procedures and reduce the number of pay action requests rejected by the Pay Centre.

In transitioning to the new Phoenix pay system, large backlogs and delays at the Pay Centre have led to a significant increase in pay-related issues reported by employees. Between April 21 and June 30, the department issued over 100 salary advances to employees whose pay was interrupted. To support employees at highest risk, a priority system has been implemented for triaging and escalating pay issues, to ensure that the most urgent cases are resolved as quickly as possible. Departmental governance committees have been used on an ongoing basis to discuss issues related to Phoenix and to develop solutions, and unions have been engaged to ensure that employees’ perspectives are represented. Moreover, the Department has strengthened its internal controls to ensure additional measures were put in place to allow for an appropriate transition to the new pay system.

4.2 Significant Changes in Relation to Programs

Disaster Financial Assistance Arrangements

The Disaster Financial Assistance Arrangements (DFAA) contribution program was established in 1970 to provide a consistent and equitable mechanism for federal sharing of provincial and territorial costs for natural disaster response and recovery where such costs would place an undue burden on a provincial or territorial economy.

There are currently 78 natural disasters for which Orders-in-Council (OiCs) have been approved, authorizing the provision of federal financial assistance under DFAA, and for which final payments have not yet been made. After taking into account all of the 2016-17 anticipated payments, the total estimated share is $2.6 billion at the end of the first quarter, the majority of which is expected to be paid out over the next five years.

The five most significant events represent 68 percent of Public Safety Canada’s current liabilities under the DFAA:

- Alberta 2013 June Flood ($877 million);

- Manitoba 2011 Spring Flood ($349 million);

- Alberta 2016 Wildfires ($221 million);

- Manitoba 2014 June Rainstorm ($159 million); and

- Saskatchewan 2011 Spring Flood ($152 million).

The recent 2016 Alberta Wildfires that took place in Fort McMurray, added significantly to the federal liability of the DFAA Program. An initial advance payment of $307 million was made to the province of Alberta on June 27, 2016 under the DFAA. As stated by the Prime Minister on May 6, 2016, the Government of Canada will also match every dollar donated to the Canadian Red Cross in support of the Fort McMurray relief effort. The commitment will apply to individual charitable donations made within Canada between May 3rd, 2016 and May 31st, 2016.

Passenger Protect Inquiries Office

On June 10, 2016, the Honourable Ralph Goodale, Minister of Public Safety and Emergency Preparedness announced that Canada was launching a new Passenger Protect Inquiries Office (PPIO). This new office is in place to provide advice and assistance to individuals who have experienced travel delays or difficulties related to aviation security lists.

This is part of the Government’s plans to introduce a redress system that will allow individuals whose names closely match those on the Secure Air Travel Act list under the Passenger Protect Program to apply for a unique identification number. Those passengers will be able to use this number at the time of a ticket purchase to clear their name in advance and prevent delays at airports. To put this new system in place, important regulatory and data system changes are required. While those changes are underway, it may still take more than 18 months before they can be fully implemented.

Public Safety Canada has not received any additional authorities to coordinate the launch of the new PPIO. National and Cyber Security Branch (NCSB) is utilizing internal resources to fulfill its role within the context of this operation.

4.3 Significant Changes in Relation to Personnel

Mr. François Guimont retired from his position as the Deputy Minister of Public Safety Canada on March 31, 2016.

On April 4, 2016, the Prime Minister appointed Mr. Malcolm Brown as Deputy Minister of Public Safety Canada.

5.0 Approval by Senior Officials

Approved by:

Malcolm Brown, Deputy Minister

Public Safety Canada

Ottawa (Canada)

Date: August 8, 2016

Mark Perlman, CPA, CMA,

Chief Financial Officer and Assistant Deputy Minister of the Corporate Management Branch

Public Safety Canada

Ottawa (Canada)

Date: August 3, 2016

6.0 Statement of Authorities (unaudited)

| Total available for use for the year ending March 31, 2017 (1) |

Used during the quarter ended June 30, 2016 |

Year to date used at quarter-end |

|

|---|---|---|---|

Vote 1 - Net Operating Expenditures |

128,080,019 | 27,195,868 | 27,195,868 |

| Vote 5 - Grants and Contributions | 952,867,801 | 337,507,534 | 337,507,534 |

| Employee Benefit Plans (EBP) | 15,927,088 | 3,981,772 | 3,981,772 |

| Minister's Salary and Motor Car Allowance (2) | 83,500 | 6,958 | 6,958 |

| TOTAL AUTHORITIES | 1,096,958,408 | 368,692,132 | 368,692,132 |

(1) Includes only authorities available for use and granted by Parliament at quarter end.

(2) Due to timing, Minister's Salary and Motor Car Allowance does not reflect full expenditures incurred during the quarter ended June 30, 2016. The adjustment is expected to be reflected in future Quarterly Financial Reports.

| Total available for use for the year ending March 31, 2016 (1) |

Used during the quarter ended June 30, 2015 |

Year to date used at quarter-end |

|

|---|---|---|---|

| Vote 1 - Net Operating Expenditures | 117,700,712 | 22,714,093 | 22,714,093 |

| Vote 5 - Grants and Contributions | 999,798,024 | 22,610,683 | 22,610,683 |

| Employee Benefit Plans (EBP) | 14,952,248 | 3,672,330 | 3,672,330 |

| Minister's Salary and Motor Car Allowance | 82,100 | 20,525 | 20,525 |

| TOTAL AUTHORITIES | 1,132,533,084 | 49,017,631 |

49,017,631 |

(1) Includes only authorities available for use and granted by Parliament at quarter end.

7.0 Departmental budgetary expenditures by Standard Object (unaudited)

Planned expenditures |

Expended during the quarter ended June 30, 2016 |

Year to date |

|

|---|---|---|---|

| Expenditures: | |||

| Personnel | 108,609,936 | 27,289,444 | 27,289,444 |

| Transportation and communications | 3,539,090 | 478,794 | 478,794 |

| Information | 6,288,012 | 293,271 | 293,271 |

| Professional and special services | 19,024,219 | 3,310,175 | 3,310,175 |

| Rentals | 3,806,779 | 677,681 | 677,681 |

| Repair and maintenance | 412,822 | 37,179 | 37,179 |

| Utilities, material and supplies | 934,225 | 77,903 | 77,903 |

| Acquisition of land, buildings and works | 1,959,830 | - | - |

| Acquisition of machinery and equipment | 2,215,694 | 142,650 | 142,650 |

| Transfer payments | 952,867,801 | 337,507,534 | 337,507,534 |

| Public debt charges | - | - | - |

| Other subsidies and payments | - | (597) | (597) |

| Total gross budgetary expenditures | 1,099,658,408 | 369,814,034 | 369,814,034 |

| Less Revenues netted against expenditures: Interdepartmental Provision of Internal Support Services | 2,700,000 | 1,121,902 | 1,121,902 |

| Total net budgetary expenditures | 1,096,958,408 | 368,692,132 | 368,692,132 |

(1) Includes only planned expenditures against authorities for use and granted by Parliament at quarter end.

Planned expenditures |

Expended during the quarter ended June 30, 2015 |

Year to date used at quarter-end |

|

|---|---|---|---|

| Expenditures: | |||

| Personnel | 103,785,416 | 24,806,460 | 24,806,460 |

| Transportation and communications | 2,694,845 | 538,866 | 538,866 |

| Information | 4,890,153 | 158,566 | 158,566 |

| Professional and special services | 15,803,334 | 1,536,252 | 1,536,252 |

| Rentals | 2,326,294 | 62,456 | 62,456 |

| Repair and maintenance | 1,123,585 | 32,360 | 32,360 |

| Utilities, material and supplies | 934,443 | 53,600 | 53,600 |

| Acquisition of land, buildings and works | 1,298,639 | - | - |

| Acquisition of machinery and equipment | 2,508,469 | 237,645 | 237,645 |

| Transfer payments | 999,798,024 | 22,610,683 | 22,610,683 |

| Public debt charges | - | - | - |

| Other subsidies and payments | 69,882 | 46,148 | 46,148 |

| Total gross budgetary expenditures | 1,135,233,084 | 50,083,036 | 50,083,036 |

Less Revenues netted against expenditures: Interdepartmental Provision of Internal Support Services |

2,700,000 | 1,065,405 | 1,065,405 |

| Total net budgetary expenditures | 1,132,533,084 | 49,017,631 | 49,017,631 |

(1) Includes only planned expenditures against authorities for use and granted by Parliament at quarter end.

- Date modified: