Disaster Financial Assistance Arrangements (DFAA)

In the event of a large-scale natural disaster, the Government of Canada provides financial assistance to provincial and territorial governments through the Disaster Financial Assistance Arrangements (DFAA), administered by Public Safety Canada (PS).

New Guidelines for the DFAA came into effect on January 1, 2008 and are currently in effect until March 31, 2025. They will apply to natural disasters which occur on or after that date. The previous Guidelines still apply for events which occurred on or prior to December 31, 2007, and for which PS is currently working with provinces and territories on finalizing payments.

On this page

Overview

In the event of a large-scale natural disaster, the Government of Canada provides financial assistance to provincial and territorial governments through the DFAA, administered by PS. When response and recovery costs exceed what individual provinces or territories could reasonably be expected to bear on their own, the DFAA provide the Government of Canada with a fair and equitable means of assisting provincial and territorial governments.

Through the DFAA, assistance is paid to the province or territory – not directly to affected individuals, small businesses, or communities. A request for reimbursement under the DFAA is processed immediately following receipt of the required documentation of provincial/territorial expenditures and a review by federal auditors.

Since the DFAA program was established in 1970, the Government of Canada has contributed over $9 billion in post-disaster assistance to help provinces and territories with the costs of response and of returning infrastructure and personal property to pre-disaster condition.

DFAA Program Review

Disasters are increasing in frequency and severity across Canada. Public Safety Canada is reviewing its program for post-disaster financial assistance to ensure there is an updated, comprehensive system available to provinces and territories for disaster recovery and to support the safety and well-being of Canadians

An independent expert advisory panel was appointed in March 2022 to review and make recommendations on how to improve the sustainability and long-term viability of the program.

The advisory panel represented a diverse interdisciplinary group that:

- is aware of natural disasters in Canada and how they affect Canadians of diverse backgrounds, including Indigenous communities,

- has expertise in disaster financing or the economic and social impacts of disasters,

- has knowledge of disaster financing in a multijurisdictional context, and

- is committed to building community resilience capacity.

Meet the members of the advisory panel for the Disaster Financial Assistance Arrangements program review.

In late 2022 , the advisory panel presented its work in a final report titled: “Building Forward Together: Toward a more resilient Canada”. The report outlines key findings and recommendations on how to modernize the DFAA program to not only support disaster recovery, but also help build more resilient communities.

The report does not make recommendations on specific program changes, as programmatic decisions are the purview of governments. The Government of Canada is reviewing the report to inform decision-making and next steps for an updated program design.

Roles and Responsibilities

The provincial or territorial governments design, develop and deliver disaster financial assistance, deciding the amounts and types of assistance that will be provided to those that have experienced losses. The DFAA place no restrictions on provincial or territorial governments in this regard - they are free to put in place the disaster financial assistance appropriate to the particular disaster and the circumstances, and the DFAA set out what costs will be eligible for cost-sharing with the federal government.

PS works closely with the province or territory to review provincial/territorial requests for reimbursement of eligible response and recovery costs.

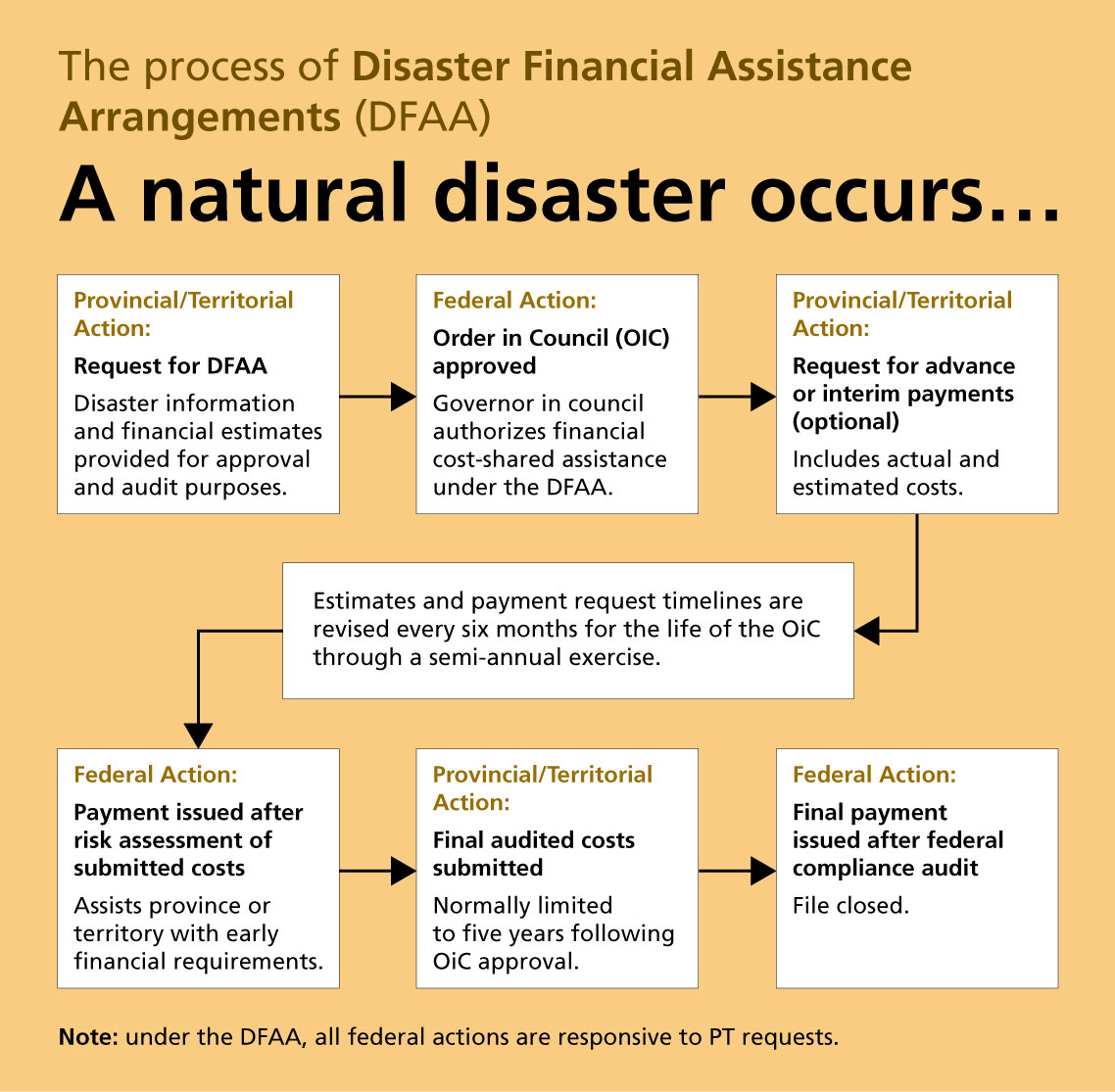

Image Description

DFAA Process

In the event of a large-scale natural disaster, the Government of Canada provides financial assistance to provincial and territorial governments through the Disaster Financial Assistance Arrangements (DFAA).

When response and recovery costs exceed what individual provinces or territories could reasonably be expected to bear on their own, a province or territory may request Government of Canada disaster financial assistance. A request for reimbursement under the DFAA is processed immediately following receipt of the required documentation of provincial or territorial expenditures and a review by federal auditors.

The application process requires provincial or territorial action as well as federal action. Steps of the application process are outlined as follows:

Step 1 – Provincial or Territorial Action:

Following a natural disaster, the province or territory submits a request for assistance under the DFAA program through an Order-in-Council. As part of this request, the province or territory provides disaster information and financial estimates for approval and audit purposes.

Step 2 – Federal Action

The Order-in-Council is approved and financial cost-shared assistance under the DFAA is authorized.

Step 3 – Provincial or Territorial Action:

The province or territory may request advance interim payments by providing actual and estimated costs. This step is optional. Estimates and payment request timelines are revised every six months for the life of the Order-in-Council through a semi-annual exercise.

Step 4 – Federal Action:

The Government of Canada issues payment after completing a risk assessment of submitted costs. The Government of Canada assists the province or territory with early financial requirements.

Step 5 – Provincial or Territorial Action

The province or territory submits final audited costs. This is limited to a five year time period following the approval of the Order-in-Council.

Step 6 – Federal Action:

Final payment issued after completing a federal compliance audit. The file is then closed.

Cost-Sharing

A province or territory may request Government of Canada disaster financial assistance when eligible expenditures exceed an established initial threshold (based on provincial or territorial population). For more information, please consult Appendix A.

Eligible expenses include, but are not limited to, evacuation operations, restoring public works and infrastructure to their pre-disaster condition, as well as replacing or repairing basic, essential personal property of individuals, small businesses and farmsteads. For further information on eligible expenses, please consult Appendix B.

The Government of Canada may provide advance and interim payments to provincial and territorial governments as funds are expended under the provincial or territorial disaster assistance program. All provincial or territorial requests for DFAA cost-sharing are subject to federal audit to ensure that cost-sharing is provided according to the DFAA Guidelines.

Appendix A

Cost-Sharing Formula effective January 1, 2024

Effective January 1, 2024, the initial threshold for all new events is defined as $3.75 per capita of the provincial population (as estimated by Statistics Canada to exist on July 1st in the calendar year of the disaster). Once the threshold is exceeded, the federal share of eligible expenses is determined by the formula in Table 11.

| Eligible provincial/territorial expenses (per capita of population) |

Government of Canada share (percentage) |

|---|---|

| First $3.75 | 0 |

| Next $7.52 | 50 |

| Next $7.52 | 75 |

| Remainder | 90 |

The formulas will be indexed to inflation annually based on the consumer price index published by Statistics Canada. For consistency purposes, national-level data will be used to calculate inflation.

The revised formula, adjusted for inflation, will take effect on January 1 of every subsequent year, starting in 2016. The DFAA Guidelines will be updated annually during the month of February to reflect the revised formula.

Please refer to Interpretation Bulletin 5 for more information regarding the changes to the cost-sharing formula.

| Province/Territory | Q4 2023* | Threshold for DFAA |

|---|---|---|

Newfoundland and Labrador |

540,418 |

$2,026,568 |

Prince Edward Island |

175,853 |

$659,449 |

Nova Scotia |

1,066,416 |

$3,999,060 |

New Brunswick |

842,725 |

$3,160,219 |

Quebec |

8,948,540 |

$33,557,025 |

Ontario |

15,801,768 |

$59,256,630 |

Manitoba |

1,465,440 |

$5,495,400 |

Saskatchewan |

1,218,976 |

$4,571,160 |

Alberta |

4,756,408 |

$17,836,530 |

British Columbia |

5,581,127 |

$20,929,226 |

Yukon |

45,148 |

$169,305 |

Northwest Territories |

44,760 |

$167,850 |

Nunavut |

40,817 |

$153,064 |

*Population estimates will be revised quarterly as new data is made available by Statistics Canada.

Example: For a disaster in a province with a population of 1 million where the total eligible expenses for responding to and recovering from a disaster are $20 million, the table below shows how eligible expenditures would be cost-shared through the DFAA.

| Eligible Expenses | Provincial or Territorial Government | Government of Canada |

|---|---|---|

First $3.75 per capita |

$3,750,000 |

Nil |

Next $7.52 per capita (50%) |

$3,760,000 |

$3,760,000 |

Next $7.52 per capita (75%) |

$1,880,000 |

$5,640,000 |

Remainder (90%) |

$121,000 |

$ 1,089,000 |

TOTAL |

$9,511,000 |

$10,489,000 |

Appendix B

Examples of provincial/territorial expenses that may be eligible for cost-sharing under the DFAA:

- Evacuation, transportation, emergency food, shelter and clothing;

- Emergency provision of essential community services;

- Security measures including the removal of valuable assets and hazardous materials from a threatened area;

- Repairs to public buildings and related equipment;

- Repairs to public infrastructure such as roads and bridges;

- Removal of damaged structures constituting a threat to public safety;

- Restoration, replacement or repairs to an individual's dwelling (principal residence only);

- Restoration, replacement or repairs to essential personal furnishings, appliances and clothing;

- Restoration of small businesses and farmsteads including buildings and equipment; and

- Costs of damage inspection, appraisal and clean up.

Examples of expenses that would NOT be eligible for cost-sharing:

- Repairs to a non-primary dwelling (e.g. cottage or ski chalet);

- Repairs that are eligible for reimbursement through insurance;

- Costs that are covered in whole or in part by another government program (e.g. production/crop insurance);

- Normal operating expenses of a government department or agency;

- Assistance to large businesses and crown corporations;

- Loss of income and economic recovery; and

- Forest firefighting, except where they pose a threat to built-up areas.

Disaster Financial Assistance Arrangements (DFAA) News Releases

-

Minister Sajjan announces disaster recovery funding to Yukon for floods

May 6, 2024 -

Government of Canada provides disaster recovery funding to Northwest Territories

September 11, 2023 -

Government of Canada provides disaster recovery funding to British Columbia for spring floods

April 19, 2023

More Disaster Financial Assistance Arrangements (DFAA) News Releases

Emergency Management Publications and Reports

- Government of Canada Response to the Public Order Emergency Commission Recommendations

- Advancing the Federal-Provincial-Territorial Emergency Management Strategy: Areas for Action

- Evaluation of the Initiatives to Address Post-Traumatic Stress Injuries (PTSI) Evaluation Report

- Summary of the Evaluation of the Initiatives to Address Post-Traumatic Stress Injuries (PTSI) Among Public Safety Officers

- The First Public Report of the National Risk Profile

- Date modified: