Horizontal Evaluation of the Measures to Address Contraband Tobacco 2012-2013

Table of contents

Note: [ * ] indicates severances made under the Access to Information and Privacy Act.

Executive Summary

This is the 2012-2013 Horizontal Evaluation of the Measures to Address Contraband Tobacco (MACT). Evaluation supports accountability to Parliament and Canadians by helping the Government of Canada to credibly report on the results achieved with resources invested in programs. Evaluation supports deputy heads in managing for results by informing them about whether their programs are producing the outcomes that they were designed to achieve, at an affordable cost; and, supports policy and program improvements by helping to identify lessons learned and best practices.

What we examined

The government announced the MACT in 2010, to help strengthen tobacco control, and advance initiatives aimed at reducing the availability and demand for contraband tobacco with a particular focus on organized crime activities. Time-limited funding of $17 million over three years was allocated to five federal departments/agencies for the following measures:

- Royal Canadian Mounted Police

- Combined Forces Special Enforcement Unit - Contraband Tobacco Team in Cornwall, Ontario, for investigative purposes.

- A dedicated liaison resource to increase awareness of the dangers of organized crime involvement in contraband tobacco.

- Public Prosecution Service of Canada

- Legal advice to the Contraband Tobacco Team and prosecution services.

- Canada Border Services Agency

- Contraband Tobacco Detector Dog Teams in the Vancouver International Mail Center and in the marine port of Montreal.

- Research and develop new scientific methods to determine the origin of tobacco and to compare tobacco products to support law enforcement efforts to target criminal groups (herein refer to as the Laboratory).

- Canada Revenue Agency

- An advertising campaign aimed at increasing public awareness among young adults in Ontario and Quebec concerning the sale of contraband tobacco in financing criminal activities.

- Public Safety Canada

- Development and delivery of a performance measurement strategy, and to conduct a horizontal evaluation during the third-year.

Funding approval requirements for this time-limited initiative specified that an evaluation be conducted in the third year of the Initiative.

Over the past decade, the Government of Canada has introduced numerous initiatives to address tobacco control, including the Federal Tobacco Control Strategy (Health Canada) in 2001; the Contraband Tobacco Enforcement Strategy (the Royal Canadian Mounted Police) in 2008; the Task Force on Illicit Tobacco Products (Public Safety Canada) in 2008; and, most recently, the Anti-Contraband Tobacco Force (the Royal Canadian Mounted Police) in 2013.

Why it is important

Increasingly, organized criminal networks are involved in contraband tobacco trade. Often, organized crime activities extend beyond interprovincial and international borders, necessitating the need for federal involvement. As the contraband tobacco market is estimated to represent a relatively significant portion of the total tobacco market, it is important for the government to invest in efforts to reduce the availability of and demand for contraband tobacco. Finally, these illegal activities affect the public safety, health and economic well-being of Canadians.

What we found

- Contraband tobacco initiatives remain relevant given the impact of contraband tobacco on the safety, economic well-being, and health of Canadians.

- Contraband tobacco initiatives align with federal government priorities and departmental strategic outcomes.

- The MACT is aligned with the federal roles of partner departments/agencies that involve leadership of multi-jurisdictional efforts, enforcement and prosecution of offences related to organized crime and contraband tobacco. In terms of duplication or synergy, the MACT shares expected outcomes with other federal tobacco initiatives; there are synergies at the operational level with federal and provincial law enforcement agencies.

- Public Safety Canada engaged all MACT partners during the development of the inception documents. However, there was limited overall horizontal engagement and reporting led by Public Safety Canada. Beyond the governance of the MACT, there is a need for an integrated whole-of-government approach, to coordinate and leverage the results and outcomes of all federal contraband tobacco related initiatives/activities with objectives similar to the MACT.

- In general, the MACT resulted in additional capacity to conduct investigations, enforcement and prosecutions. Searches conducted by the contraband tobacco detector dogs intensified greatly during the MACT period. However, it did not translate into a high number and volume of seizures. [ * ]

- Although attribution is difficult because many law enforcement organizations operate in the Cornwall area, evidence illustrates that the MACT had disrupted the structure and networks of organized crime groups to some extent. The MACT may have contributed to reduced availability of contraband tobacco. Demand remained relatively stable.

- The “reach” of community and public awareness activities appears to be widespread. However, it cannot be determined to what extent the MACT contributed to increased awareness that purchasing contraband cigarettes helps finance criminal activities, or awareness of the dangers of organized crime involvement in contraband tobacco.

- It is reasonable to conclude that the break-even point for the federal investment on the Contraband Tobacco Team was realized. The Contraband Tobacco Detector Dog Teams were increasingly more cost-efficient in conducting searches. Based on seizure results alone, the two dog teams were not found to be cost-effective. There is insufficient performance and financial information to determine efficiency and economy of the other measures.

Recommendation

Given that the MACT sunsets in March 2013, the following recommendation applies, as lessons learned, to all ongoing and/or future contraband tobacco initiatives.

The Internal Audit and Evaluation Directorate recommends that the Assistant Deputy Minister, Community Safety and Countering Crime BranchFootnote 1 of Public Safety Canada:

Engage federal departments/agencies participating in contraband tobacco initiatives and activities to establish a strategic level forum to leverage the results and outcomes of all federal investment in contraband tobacco related initiatives/activities to inform and support future policy and program decision-making with a whole-of-government approach.

Management Response and Action Plan

In recognition of the time-limited nature of the initiatives, the Community Safety and Countering Crime Branch (CSCC) of Public Safety Canada accepts the recommendation of the Measures to Address Contraband Tobacco (MACT) in support of future best practices. In collaboration with its portfolio agencies (the Royal Canadian Mounted Police and the Canada Border Services Agency) and other relevant federal departments, Public Safety Canada will continue to lead and develop concrete and effective measures to reduce the problem of contraband tobacco.

Contraband tobacco is a highly complex, multi-jurisdictional issue that requires a whole-of-government approach to ensure that legislative, policy and operational responses are integrated, collaborative and complementary to existing anti-contraband and tobacco control measures. To this end, CSCC will continue to engage with federal departments and agencies responsible for: the Contraband Tobacco Enforcement Strategy, the Federal Tobacco Control Strategy, the Akwesasne Partnership Initiative and the recently announced Anti-Contraband Tobacco Force to design and establish a strategic level forum whereby information on key activities, results and trends can be exchanged for the purpose of future policy development and program planning.

| Management Action Plan | Deliverables | Planned Completion Date |

|---|---|---|

|

|

December 2013 |

|

|

March 2014 |

1. Introduction

This is the Public Safety Canada 2012-2013 Horizontal Evaluation of the Measures to Address Contraband Tobacco (MACT). This evaluation provides Canadians, parliamentarians, Ministers, central agencies, and deputy heads with an evidence-based, neutral assessment of the relevance and performance (effectiveness, efficiency and economy) of this federal government horizontal initiative.

2. Profile

2.1 Background

In July 2008, the Government of Canada joined with all provinces in a landmark settlement concerning tobacco smuggling which saw two major Canadian tobacco companies agree to pay $1.15 billion in fines. Following this settlement, the Government announced the MACT, which is a three-year, $17 million time-limited initiative that began in 2010-2011.

Over the past decade, the Government of Canada has introduced numerous initiatives to address tobacco control, including the Federal Tobacco Control Strategy (Health Canada) in 2001; the Contraband Tobacco Enforcement Strategy (the Royal Canadian Mounted Police) in 2008; the Task Force on Illicit Tobacco Products (Public Safety Canada) in 2008; and, most recently, the Anti-Contraband Tobacco Force (the Royal Canadian Mounted Police) in 2013.

2.2 Funding and Objectives

The MACT was intended to strengthen tobacco control, and advance initiatives aimed at reducing the availability and demand for contraband tobacco with a particular focus on organized criminal activities.Footnote 2

Five federal partners were funded to implement the following measures:

- Royal Canadian Mounted Police (RCMP)

- To establish a Combined Forces Special Enforcement Unit-Contraband Tobacco Team in Cornwall, Ontario, an area with a high level of contraband activity. The Contraband Tobacco Team's mandate is to uncover, investigate and disrupt the structure and network of organized crime groups involved in contraband tobacco. The team is composed of officers from the RCMP, the Ontario Provincial Police, the Cornwall Community Police Service, the Ontario Ministry of Finance, and the Canada Border Service Agency (not funded through the MACTFootnote 3).

- To dedicate a liaison resource to increase awareness of the dangers of organized crime involvement in contraband tobacco for the benefit of the Cornwall community and businesses.

- Public Prosecution Service of Canada (PPSC)

- To provide legal advice to the Contraband Tobacco Team at the investigation stage and prosecution services following the completion of investigations.

- Canada Border Services Agency (CBSA)

- To establish detector dog teams to detect contraband tobacco in the Vancouver International Mail Center and in the marine port of Montreal.

- To undertake a Tobacco Origin Analysis initiative by the Science and Engineering Directorate (herein referred to as the Laboratory) that conduct research and develop new methods to determine the origin of seized tobacco, and to compare tobacco products to support law enforcement efforts to target criminal groups.

- Canada Revenue Agency (CRA)

- To conduct an advertising campaign aimed at increasing public awareness of young adults in Ontario and Quebec, concerning the sale of contraband tobacco in financing criminal activities.

- Public Safety Canada (PS)

- To lead the development and delivery of a performance measurement strategy, and to conduct a horizontal evaluation during the third-year funding period.

2.3 Resources

Table 1 illustrates the allocation for each partner that delivered the MACT activities for the three-year period starting in 2010-2011.

| Partner | Allocation ($) | % of Total |

|---|---|---|

| RCMP | 7,410,000 | 44% |

| PPSC | 990,000 | 6% |

| CBSA | 3,480,000 | 20% |

| CRA | 4,970,000 | 29% |

| PS | 160,000 | 1% |

| Total | 17,010,000 | 100% |

Note:

- Allocation figures include salary (including employee benefits plan and Public Works and Government Services Canada accommodation allowances), operations and maintenance, and capital.

- Separate allocation figures for specific initiatives are not available for the Canada Border Services Agency initiatives (Detector Dog Service and Laboratory) and the Royal Canadian Mounted Police initiatives (Contraband Tobacco Team and community outreach activities).

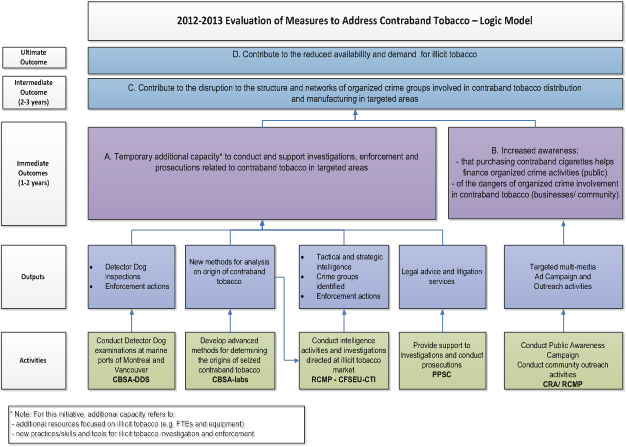

2.4 Logic Model

The logic model presented as Figure 1 is a visual representation that links what the MACT was funded to do (activities) with what the MACT was expected to produce (outputs) and achieve (outcomes). It also provides the basis for developing the evaluation matrix, which gave the evaluation team a roadmap for conducting this evaluation.

Figure 1: MACT Logic Model

Image Description

These are the activities of the MACT, along with the department and unit responsible, and their corresponding outputs:

Activity 1: conduct Detector Dog examinations at marine ports of Montreal and Vancouver (CBSA-DDS). Outputs for activity 1: detector dog inspections and enforcement actions.

Activity 2: develop advanced methods for determining the origins of seized contraband tobacco (CBSA-labs). Outputs for activity 2: new methods for analysis on origin of contraband tobacco.

Activity 3: conduct intelligence activities and investigations directed at illicit tobacco market (RCMP - CFSEU-CTI). Outputs for activity 3: tactical and strategic intelligence, crime groups identified, and enforcement actions.

Activity 4: provide support to investigations and conduct prosecutions (PPSC). Outputs for activity 4: legal advice and litigation services.

Activity 5: conduct Public Awareness Campaign and conduct community outreach activities (CRA/ RCMP). Outputs for activity 5: targeted multi-media ad campaign and outreach activities

Outputs for activity 2 contribute to activity 3.

Activities and outputs for activities 1,2 3 and 4 lead to immediate outcome A: temporary additional capacity (refer to the note) to conduct and support investigations, enforcement and prosecutions related to contraband tobacco in targeted areas.

Activity 5 and corresponding outputs lead to immediate outcome B: Increased awareness: that purchasing contraband cigarettes helps finance organized crime activities (public); and of the dangers of organized crime involvement in contraband tobacco (businesses/ community).

Immediate outcomes lead to intermediate outcome C: contribute to the disruption to the structure and networks of organized crime groups involved in contraband tobacco distribution and manufacturing in targeted areas.

Intermediate outcome C lead to final outcome D: contribute to the reduced availability and demand for illicit tobacco.

Note: For this initiative, additional capacity refers to: additional resources focused on illlicit tobacco (e.g. FTEs and equipment); and new practices/skills and tools for illicit tobacco investigation and enforcement.

3. About The Evaluation

3.1 Objective

This evaluation supports:

- accountability to Parliament and Canadians by helping the Government to credibly report on the results achieved with resources invested in this initiative;

- deputy heads of partner departments/agencies in managing for results by informing them about whether this initiative is producing the outcomes that it was designed to produce, at an affordable cost; and

- policy and program improvements.

3.2 Scope

Funding approval requirements for this time-limited initiative specified that an evaluation be conducted in the third year of the initiative. As required by the Treasury Board Policy on Evaluation, the evaluation assessed the relevance and performance:

- continued need,

- alignment with government priorities,

- consistency with federal roles and responsibilities,

- the achievement of expected outcomes, and

- a demonstration of efficiency and economy.

3.3 Methodology

The evaluation was conducted in accordance with the Treasury Board Policy on Evaluation, the Directive on the Evaluation Function; the Standard on Evaluation for the Government of Canada; and the Guidance on the Governance and Management of Evaluations of Horizontal Initiative.

The evaluation was a goal-based, implicit design, and evaluators took into account the following factors in order to calibrate the evaluation effort, including the approach, scope, design and methods:

- risks;

- quality of past evaluations (MACT are time-limited and no previous evaluations had been undertaken);

- soundness of program theory; and

- longevity of the program.

3.3.1 Evaluation Core Issues and Questions

As required by the Directive on the Evaluation Function, the following issue areas and evaluation questions were addressed in the evaluation:

Relevance

- What need was the MACT intended to address and to what extent does the need persist?

- To what extent is the MACT aligned with government-wide priorities and supportive of strategic outcomes of partner departments/agencies?

- a. To what extent is the MACT aligned with federal roles and responsibilities?

b. To what extent does the MACT duplicate or complement other similar programs?

Performance—Effectiveness

- To what extent have the MACT's expected outcomes been achieved?

- Was a horizontal approach the most appropriate method for the MACT?

- Extent to which additional capacity to conduct investigations, enforcement and prosecutions has been realized;

- Extent to which there has been increased, i) awareness that purchasing contraband cigarettes helps finance organized crime activities, and ii) awareness of the dangers of organized crime involvement in contraband tobacco;

- Extent to which there has been disruption to the structure and networks of organized crime groups; and

- Extent to which there has been a reduction in the availability and demand for contraband tobacco.

Performance—Efficiency and Economy

- a. Is the progress made towards expected outcomes adequate for the resources expended?

b. To what extent does the program's delivery mechanism minimize the use of resources in realizing outputs and outcomes?

3.3.2 Lines of Evidence

The evaluation team used the following lines of evidence: document review, interviews, and a review of performance and financial data. Each of these lines of evidence is described in more detail below.

Document Review

The document review included the following types of documents: corporate documents, accountability and policy documents, inception documents, government publications, research studies and reports, departmental reports on plans and priorities, departmental performance reports, speeches from the Throne, legislative documents, program-specific documents and media articles. A list of documents reviewed is presented at Annex B.

Interviews

In total, 26 interviews were conducted. Interviewees included policy and program representatives (8) and law enforcement personnel/field personnel from the five MACT partners (11). Other interviewees (7) included stakeholders from non-MACT partner organizations (e.g. provincial/municipal law enforcement agencies, the Ontario Ministry of Finance, community organizations). It is noted that some interviewees were able to offer perspectives from different angles. For example, there were law enforcement personnel from provincial/municipal law enforcement agencies who were seconded to the Contraband Tobacco Team. These interviewees could offer knowledge as field personnel of the Team as well as provide opinions about the MACT as members of their home organizations.

Review of Financial and Performance Information

An analysis of performance data included the examination of program output and outcome data and documents such as self-assessment of programs and status reports. The financial analysis included the assessment of program budget and expenditure information and the cost to federal government.

3.4 Limitations

The following section describes the methodological limitations and how the evaluation team addressed these limitations:

- The evaluation was conducted during 2012-2013, before the MACT expired on March 31, 2013. Consequently, the evaluation assessed each initiative funded under the MACT based on the progress that had been made at the time of the evaluation and based on data and information available.

- Numerous federal and provincial tobacco control initiatives, involving many organizations at all levels, are concurrent in Canada. Therefore, it is not possible to attribute results to a single initiative or organization. In several cases, the evaluation team examined how the MACT contributed to overall intended results.

- Although qualitative information from interviews was analyzed using a systematic approach, the information only represents the viewpoints of selected interviewees. Evaluators exercised judgment in creating themes from interviewee responses. Where possible, the evaluation addressed this limitation by supplementing interview information with quantitative information and document review.

- As will be explained later on in the report, there was no data available on the impact of the advertising campaign (CRA) and awareness activities amongst the Cornwall community and businesses (RCMP). Thus, the evaluation team examined data available on the advertising and awareness activities that had been conducted (i.e. outputs) by each respective organization and included this topic in interview discussions. The evaluation team did not conduct public opinion research as part of the evaluation of the MACT.

3.5 Protocols

During the conduct of the evaluation, program representatives from the RCMP, the PPSC, the CBSA, the CRA, and PS in collaboration with their respective evaluation units, assisted in the identification of key stakeholders to interview, and provided documentation, data and information to support the evaluation. Collaborative participation greatly enriched the evaluation process.

4. Findings

4.1 Relevance

4.1.1 Need for the Measures to Address Contraband Tobacco

In order to establish if there is a continuing need for the MACT, the evaluation examined the relative size of the contraband tobacco market in Canada and the impact of contraband tobacco on the Canadian population in the areas of public safety, economy and health. Given the focus of the MACT activities in the provinces of Ontario and Quebec, the evaluation also examined the extent of contraband tobacco activities in these two provinces, and in particular in the Cornwall/Valleyfield area.

Size and Impact of the Contraband Tobacco Market in Canada

Numerous attempts have been made to estimate the proportion of the contraband tobacco market in relation to the legal market. Several studies, conducted in 2009 and 2010, estimate this figure to be as low as 7.6% and as high as 20.7%.Footnote 4 From an economic standpoint, contraband tobacco has an impact on government revenues as excise taxes are not collected. It also has an impact on legitimate businesses (e.g., tobacco companies, convenience stores) that suffer the loss of sales of legal cigarettes. The National Coalition against Contraband Tobacco estimated that the federal government loses over $1 billion annually in tax revenue from the contraband tobacco market.Footnote 5 It was estimated that the seizures of cigarettes and fine-cut tobacco seized by the RCMP in 2010 alone represented approximately $47 million in lost provincial and federal taxes.Footnote 6 In 2010, convenience stores estimated revenue “losses of more than $2.5 billion in sales or lost profits of $260 million”.Footnote 7

Recent evidence shows an increasing link between the contraband tobacco market and organized crime.Footnote 8 The RCMP reported that approximately 105 organized crime groups were involved in the contraband tobacco trade in 2008, equivalent to roughly 15% of total number of organized crime groups in Canada.Footnote 9 Organized crime groups have extended their involvement into a much more diversified market of criminal activity, predominantly in drug trafficking, but also in other areas such as tobacco and human trafficking.Footnote 10

From a health perspective, contraband tobacco is more affordable than legal cigarettes and hinders government efforts aimed at reducing smoking amongst Canadians. The RCMP estimated that the cost to produce 200 contraband cigarettes (equal to one carton) is as little as $6, while legitimate tobacco products are sold for $75-90 per carton.Footnote 11

In addition, contraband tobacco is more accessible to youth who might not otherwise have the means to purchase legal tobacco products. A 2009 article in the Canadian Medical Association Journal stated that “contraband cigarettes accounted for about 17.5% of all cigarettes smoked by adolescent daily smokers in Canada overall, and for more than 25% in the provinces of Ontario and Quebec”.Footnote 12 Another study has reported this percentage to be 43% among highschool daily smokers in Ontario in 2010.Footnote 13 Criminal organizations may also target youth to conduct illegal activities, as an easy way to make money.Footnote 14

Extent of Contraband Tobacco Activities in Ontario and Quebec

The RCMP notes that contraband tobacco trade is “most prevalent in southeastern Ontario and southwestern Quebec”.Footnote 15 The Cornwall (Ontario) and Valleyfield (Quebec) area remains a focal point of contraband tobacco activity. Given its proximity to the Ontario-Quebec interprovincial boundary and Canada-U.S. international border, this area, which also includes the Mohawk Territory of Akwesasne, creates law enforcement jurisdictional complexities, which organized crime groups have historically exploited. Cigarette cartons and fine-cut tobacco seized by the RCMP in that particular area represented respectively 72% and 84% of the national total in 2010.”Footnote 16

The RCMP also reported that “Quebec and Ontario also have the highest concentration of illicit tobacco manufacturing operations…and that illegal tobacco activity in Canada today is primarily connected not to the diversion of legally manufactured products but to illegal manufacture.”Footnote 17 It reported that there were approximately 50 illegal cigarette factories operating on reserves in Ontario and Quebec.Footnote 18

4.1.2 Alignment with Government Priorities

The evaluation sought to assess the degree of alignment of the MACT with federal government priorities. A review of key strategic federal government documents, e.g. Speeches from the Throne and Federal Budgets, between 2010 to 2012 shows that the safety and security of Canadians remains a central theme. In recent Speeches from the Throne, the Government committed to modernize the judicial tools employed to fight organized crime and to reintroduce comprehensive law-and-order legislation to combat crime (e.g., a new Criminal Code offence for trafficking in contraband tobacco with penalties of mandatory jail time for repeat offenders).

In recent years, the federal government has demonstrated its commitment to combat the contraband tobacco issues. For example, the Government announced the RCMP Anti-Contraband Tobacco Force of 50 resources in March 2013 with an aim to reduce the contraband tobacco market and to combat organized criminal networks. In March 2013, the Minister of Public Safety stated that “tobacco trafficking is a serious threat to the public safety of Canadians, our communities and our economy. Contraband tobacco fuels the growth of organized criminal networks, contributing to the increased availability of illegal drugs and guns in our communities.”Footnote 19 Furthermore, the Government has participated in international negotiations for a protocol to eliminate the illicit trade in tobacco products under the World Health Organization's Framework Convention for Tobacco Control.

4.1.3 Alignment with a Federal Role

Alignment of the MACT with federal roles and responsibilities was determined through a review of legislative and other documents. Specifically, the evaluation sought evidence of federal accountability and authority in the areas of contraband tobacco trade and organized crime.

The activities of organized criminal organizations connected to contraband tobacco are often interprovincial and cross-border in nature—the Criminal Intelligence Service of Canada reported that approximately 40% of all organized crime groups identified in Canada in 2011 were either inter-provincial or internationalFootnote 20—thereby supporting the need for federal involvement. Contraband tobacco activities have an impact on the entire Canadian population and economy; thus also reinforcing the need for federal involvement.

Federal Leadership

PS and its portfolio organizations, RCMP and CBSA, have a broad role in the safety and security of Canadians. For example, as outlined in the RCMP Act, the organization's mandate is multi-faceted and includes the prevention of crime, the enforcement of laws and the apprehension of criminals and offenders including those involved in organized crime and contraband tobacco. Also, as established in the Canada Border Services Agency Act, the mandate of the CBSA is to provide integrated border services that support national security and public safety priorities and facilitate the free flow of goods and persons.

Federal Enforcement

The Customs Act and the Excise Act, 2001 provide the legislative authorities of primary relevance to the MACT and are the main enforcement tools of the federal government in countering different aspects of the illicit tobacco trade.Footnote 21 The RCMP and the CBSA carry out the enforcement of these acts.Footnote 22

The RCMP is responsible for the enforcement of laws within Canada in relation to the international movement of goods along the uncontrolled border (between ports of entry). Illicit manufacturing, distribution or possession of contraband tobacco products falls within its investigative mandate. Under the Excise Act 2001, the most common charges relate to the possession of tobacco for which the proper duties have not been paid and to the illegal manufacturing of tobacco products.Footnote 23

The CBSA takes direction from the Customs Act that deals primarily with the importation of any product into Canada, and the subsequent possession of any product that has not been properly reported. The most common charges relate to possession of smuggled goods and the non-reporting of goods and persons upon entering Canada. Under the Canada Revenue Agency Act, the CRA is responsible to support the administration and enforcement of relevant legislation, including the Excise Act and the Excise Act, 2001. The Excise Act, 2001 deals with the production and possession of tobacco products and alcohol. The most common charges relate to the possession of tobacco for which the proper duties have not been paid and to the illegal manufacturing of tobacco products.Footnote 24

Federal Prosecution

As set out in the Director of Public Prosecutions Act, the PPSC conducts federal prosecutions on behalf of the federal Crown and provides legal advice and assistance to law enforcement officials, such as the RCMP, at the investigative stage.

The federal and provincial governments share jurisdiction over prosecutions. This shared jurisdiction means cooperation and coordination are essential to the effective enforcement of the law, Footnote 25 as is the case with the MACT. In all provinces and territories, the PPSC prosecutes charges under federal statutes including those under the Excise Act, 2001, as well as conspiracies and attempts to violate these statutes. The PPSC is responsible for prosecuting all Criminal Code offences in the territories. In the provinces, the PPSC has shared jurisdiction with provincial crown prosecution services, to prosecute a limited number of Criminal Code offences, including those related to criminal organizations, proceeds of crime, money laundering, terrorism, and fraud. Under arrangements with the provinces, the PPSC may also prosecute Criminal Code offences that are otherwise within provincial jurisdiction when the accused also faces charges within federal jurisdiction.Footnote 26

4.1.4 Duplication and Synergy

The MACT was implemented to supplement and build upon existing federal government efforts to address tobacco control. These initiatives include the Contraband Tobacco Enforcement Strategy (RCMP) and the Federal Tobacco Control Strategy (Health Canada). In 2008, the government also created the Task Force on Illicit Tobacco Products (PS). The MACT was established, as part of the recommendations stemming from the work of the Task Force.Footnote 27

As such, and as expected, the objectives of the MACT align to the objectives of these broader federal strategies, as illustrated below:

- The Contraband Tobacco Enforcement Strategy aims to reduce the availability of and demand for contraband tobacco, with priorities on the disruption of organized crime, and outreach activities among others. The Strategy sets the framework and provides national direction to front-line officers. The MACT and this Strategy share the same goal, with the MACT having a more targeted geographic focus. In particular, measures such as the Contraband Tobacco Team and the Community Outreach activities align to the overall objective of this Strategy with a geographical focus in the Cornwall area;

- The objective of the Federal Tobacco Control Strategy is to reduce tobacco-attributable disease and death among Canadians, focusing on activities that reduce the demand of both legal and illegal tobacco products.Footnote 28 Within the MACT, the community outreach activities and the public awareness campaign are aimed at contributing to the reduction of the demand for illegal tobacco products, and therefore align to the overall objective of this Strategy.Footnote 29 Other measures within the MACT are aimed at reducing the availability of contraband tobacco products.

Besides these strategies, the evaluation found that there are several other federal initiatives aimed at combating organized crime and/or contraband tobacco that may be active in the Cornwall area.

The objective of the Cornwall Regional Task Force (RCMP) is to ensure border integrity in the area. Situated at Cornwall, a significant portion of the activities of the Cornwall Regional Task Force focuses on the smuggling of contraband tobacco throughout the region. According to law enforcement personnel, the investigations conducted by the Cornwall Regional Task Force were mainly shorter term, [* ]. In contrast, the Contraband Tobacco Team focused on longer-term investigations, with an aim to disrupt organized criminal activities.

The objective of the Akwesasne Partnership Initiative (PS) is to “contribute to the disruption of organized criminal activities in and around Akwesasne”.Footnote 30 Given the prominence of contraband tobacco activities in the Akwesasne/Cornwall/Valleyfield area, the Initiative has a particular focus on organized criminal activities related to contraband tobacco. Thus the MACT, in particular the Contraband Tobacco Team, shares very similar objective as this Initiative. The distinction between this Initiative and the MACT lies in the nature of the funded activities. This Initiative was funded to establish a Joint Investigative Team to provide the Akwesasne Mohawk Police Service with the opportunity to participate in collaborative investigative activities with the RCMP and other agencies that target organized criminal activity. Whereas, the purpose of the Contraband Tobacco Team was to provide resources to focus on the investigation of organized crime involved in contraband tobacco activities. The 2012-2013 Evaluation of the Akwesasne Partnership Initiative found that there is no duplication between this Initiative and the MACT, but also noted that very similar objectives between all these initiatives listed above. Footnote 31

The objective of the First Nations Organized Crime initiative (PS) is to promote the participation of First Nations police officers in multi-agency task forces in Ontario and Quebec, targeting organized criminal networks that deal with contraband of all kinds and cross-border criminality. The objectives, activities and intended results under this Initiative are the same as those under the Akwesasne Partnership Initiative.Footnote 32 Thus, similar to the Akwesasne Partnership Initiative, this initiative differs from the MACT in terms of the activities funded. Moreover, this initiative has a relatively much larger geographical focus and does not have a sole focus on contraband tobacco.

Overall, the Contraband Tobacco Team and members from other federal and provincial law enforcement agencies work closely together at the operational level (e.g., Cornwall Regional Task Force, Ontario Organized Crime Enforcement Bureau, Ontario Ministry of Finance). Law enforcement personnel mentioned that members from the Contraband Tobacco Team and other initiatives partnered together in investigations through the sharing of intelligence and resources. They also noted that it was essential for organizations to work together to maximize the enforcement impact in countering organized crime activities (e.g., joint investigative effort leading to individuals being charged under both federal and provincial statutes).

Having stated the above, it is noted that measures within the MACT are unique, in that each measure provides a focused effort in combating contraband tobacco. The Contraband Tobacco Team is unique in Canada; it was the only team that provided dedicated resources to combating organized criminal activities in contraband tobacco. The Detector Dog Service has been in existence to detect other commodities, but not for contraband tobacco. . The Tobacco Origin Analysis is original, that is, there were no other federal or provincial government organizations that conducted such analyses. The evaluation team has not found other national or extensive public awareness campaigns that concentrate on the impact of the sale of contraband tobacco in financing criminal activities.

4.2 Performance - Effectiveness

Performance was assessed by examining performance information collected by the MACT partners, as well as studies, reports and articles on contraband tobacco. Qualitative evidence was also gathered through interviews.

4.2.1 Horizontal Governance

Governance is generally an important foundational element of leadership, coordination, and engagement for a horizontal initiative. In consideration of this, the evaluation examined the horizontal governance approach for the MACT.

The evaluation found that during the implementation phase, there was limited horizontal engagement and reporting. Program representatives explained that because the MACT was a three-year time-limited initiative, a formal horizontal governance structure was not put in place. Policy and program representatives agreed that while it may have been appropriate to design the MACT as a horizontal initiative; the MACT did not always function as one. For example, PS was responsible for the development and delivery of a performance measurement strategy, and to conduct a horizontal evaluation during the third-year. In this regard, PS engaged the MACT partners in the development of the Performance Measurement Strategy; however, it was done very late in the three-year period. If it had been done at the outset of the MACT, it would have facilitated horizontal planning and engagement, as well as integrated performance reporting.

During the design and planning phase, PS led and coordinated the development of the inception documents, in consultation with all MACT partners. The resulting inception documents tasked individual partners to implement and monitor their own activities. As a result, partners monitored their own initiatives independently and reported to PS on an as-needed basis (e.g. Ministerial briefings), or through regular bilateral progress updates on status and outcomes and/or indirectly through pre-existing reporting mechanisms. Program representatives at both the strategic and the operational levels commented that due to the independent monitoring and reporting on performance they were not aware of the activities and results of other MACT partners, and that partners did not work together to agree on how activities feed into one another to maximize the achievement of a common set of higher-level outcomes.

4.2.2 Support to Investigations, Enforcement and Prosecutions

This section examines the extent to which the MACT funding provided partners with temporary additional capacityFootnote 33 to conduct and support investigations, enforcement and prosecutions related to contraband tobacco. This includes the activities of the RCMP's Contraband Tobacco Team and the legal advice and prosecution services provided by the PPSC. Where possible, the evaluation team compared data collected during the MACT with pre-MACT data.

RCMP Contraband Tobacco Team

Based on data provided by the RCMP, the evaluation found that the Contraband Tobacco Team initiated 20 investigations of organized crime groups involved in contraband tobacco from April 2010 to September 2012. In order to determine to what extent the MACT supplemented existing resources, the evaluation also examined the number of investigations that had been initiated by the Combined Forces Special Enforcement Unit (based out of the Cornwall detachment) in the two years prior to the implementation of the MACT. Before the MACT was put in place, investigations of organized crime groups involved in contraband tobacco were mainly assumed, within the Cornwall detachment, by the Combined Forces Special Enforcement Unit. The Unit's mandate also extended to other illegal activities.

In the two years prior to the MACT, i.e. from 2008-2009 to 2009‑2010, the Cornwall's Combined Forces Special Enforcement Unit initiated 11 investigations. In contrast, the Contraband Tobacco Team initiated 17 investigations in the first two years of the MACT. Law enforcement personnel interviewed commented that the MACT allowed the Contraband Tobacco Team to conduct longer term, higher impact investigations, targeting higher level individuals involved in criminal activities.

In addition to the number of investigations, the evaluation examined whether the MACT had contributed to the Contraband Tobacco Team's ability to identify organized crime groups involved in contraband tobacco activities and share intelligence and information with other law enforcement agencies. The evaluation found that the Team identified 11 organized crime groups involved in contraband tobacco during the first two years of the MACT, while six had been identified in the two years prior to MACT.Footnote 34 It is noted that, in 2010-2011 and 2011-2012, the proportion of organized crime groups involved in contraband tobacco identified by the Contraband Tobacco Team represented 8% and 10% of the total national number respectively. This proportion was 3% in 2008-2009 and 4%Footnote 35 in 2009-2010.

The evaluation found that the integrated model of the Contraband Tobacco Team facilitated sharing of intelligence and information. The number of intelligence reports shared by the Team increased by 38% during the first two years of the MACT period, when compared to the two years prior to MACT.

Interviewees noted that the Contraband Tobacco Team's integrated model contributed to investigators' ability to share information, intelligence, investigative skills and practices, thereby augmenting their overall knowledge and skills. This is because each member of the integrated team brings their respective knowledge and expertise from various law enforcement agencies. Finally, interviewees noted that the MACT funding also increased formal and on-the-job training opportunities (e.g. intelligence gathering and investigative techniques) and allowed for the purchase of equipment in support of investigations.

Legal Advice and Prosecution Services

Data shows that over the MACT period, the PPSC dedicated an increasing number of hours each year in support of the Contraband Tobacco Team's cases. As of January 2013, prosecutors expended approximately 4,800 hours over the MACT period, with about 70% of time spent on prosecution services and the rest of the time spent on providing legal advice. Investigators of the Contraband Tobacco Team noted that the level of service provided in support of investigations remained excellent and did not seem to vary despite an increase in demand during the MACT. This suggests that the PPSC was able to meet demand and that the MACT funding contributed to this increased capacity.

It should be noted that, as the MACT is time-limited and as the majority of cases and charges are still to be prosecuted, all remaining prosecution services will be delivered after the MACT funding expires on March 31, 2013, presumably within existing resourcing levels.

4.2.3 Tobacco Origin Analysis and Contraband Tobacco Detector Dog Service

Tobacco Origin Analysis – Science and Engineering Directorate

The Tobacco Origin Analysis Initiative provided the CBSA Laboratory the opportunity to research and to develop new scientific capabilities with an aim to support ongoing intelligence and investigative efforts of the RCMP, the CRA and the CBSA. Law enforcement personnel reported that, upon project completion, the Tobacco Origin Analysis could be helpful in narrowing down the focus of law enforcement investigations. Specifically, they commented that the analysis will allow them to compare the origin of tobacco (e.g. Canadian or American) used in the production of cigarettes and distinguish between varieties of tobacco.

The development of new scientific capabilities is a multi-step process, which includes evaluating possible techniques, purchasing equipment, developing methods, gathering reference samples, completing the chemical, biological and physical analysis of the samples and analyzing the data. At the time of evaluation, almost all of these steps were successfully completed. [ * ].

[ * ].

Results of further data analysis will provide a complete list of the added laboratory capabilities to allow for some measure of effectiveness.

Contraband Tobacco Detector Dog Service

The evaluation found that the MACT funding provided additional detection capacity for the CBSA. The funding provided the CBSA with the opportunity to become the first Canadian federal law enforcement agency to establish two detector dog teams dedicated to the detection of contraband tobacco, in the Vancouver postal mail center and in the marine port of Montreal. Its implementation provided valuable information regarding the ability of the detector dogs to detect contraband tobacco.

During the first year of the MACT, activities were focused on the hiring of dog handlers and training of detector dogs and thus, there were no searches conducted. Once deployed into the ports of entry, there was a transition period of an additional year to establish attachment between the dog and the dog handler. Therefore, the two dog teams were only able to work effectively for around six months before the data collection of this evaluation started.

From April 2011 to November 2012, a total of 37,068 searches were conducted in Vancouver and 106,270 in Montreal. However, during roughly the same period, the two dog teams made only nine seizures for a total of 47 cartons and 7.41 kilograms of fine-cut tobacco. These seizures represent about 2% to 3% of the total contraband tobacco seizures in the two designated locations. It is unclear what factors might have prevented the dog teams from achieving further success since based on the self-assessments conducted by the CBSA, the two dog teams demonstrated that their detection abilities met the standards established by the detector dog training program. It is possible that the dog teams were located in areas where the risks did not materialize into seizures.

4.2.4 Community Outreach and Public Awareness

Over the MACT period, the RCMP conducted numerous types of outreach activities in the Cornwall area. These activities included 22 presentations, four Internet advertisements, 280 radio advertisements, 500 pamphlets, 100 posters, four billboards, and other activities.

Data on the impact of these outreach activities among recipients was not available; this information was not being tracked by the program. However, some data on the “reach” of these activities was provided. For example, about 3,300 people who saw two of the internet ads clicked to seek further information from the RCMP website on contraband tobacco; presentations reached about 2,200 community members; and other activities reached approximately 2,100 individuals.

Interviewees from community organizations and law enforcement agencies stated that the outreach activities have contributed to raising awareness among communities in the Cornwall and Akwesasne areas. They stated that the local media reports of the enforcement operations also contributed to heightened awareness and that some level of awareness existed in the area prior to the MACT.

In terms of raising public awareness among youth in Quebec and Ontario, the CRA advertising campaign was launched in early February, 2011 and ended in late March, 2011. The multi‑media campaign included digital signage (large interactive boards) at 28 university campuses in Ontario and Quebec. Digital boards were also placed in 693 restaurants and bars near universities and classic 13”x17” board ads were placed in 980 campus restrooms. In addition, mega banners were placed in nine university campuses in Ontario. Ads were also placed in seven local daily and eleven weekly off-campus newspapers as well as in 62 campus newspapers on 56 campuses in Ontario and in Quebec.Footnote 36 The campaign also advertised through posters and panels in 555 Quebec convenience stores and included a Web site, which provided information that purchasing contraband tobacco helps finance organized crime activities.

Some information about the “reach” of these activities was available. As examples, the total estimated weekly circulation for 13 of the 18 local daily and weekly off-campus newspapers was estimated at approximately 4,500,000 copies. The total estimated circulation for all campus newspapers was about 403,000 with the total enrollment of about 990,000 students in all these campuses. In addition, statistics from the CRA showed that there were 2,023 visits to the website during the campaign period.

Quantitative data to evaluate the effect of the campaign on public awareness does not exist. At the time when the campaign was about to end, a general election was called. As per the Government of Canada Communications Policy (requirement 23), institutions must suspend all research including evaluations of advertising campaigns, during general elections until the newly elected government is sworn into office. The new government was sworn in on May 26, 2011, almost two months after the campaign ended. As a result, post-campaign evaluations of advertising, which were suspended because of the election and for which no fieldwork was conducted, were no longer required since any conduct of post-campaign evaluations a month or more after campaigns ended would not have produced reliable data.Footnote 37

In the absence of data to assess the impact of the campaign, the evaluation unit of the CRA undertook a study to provide some insight as to whether the campaign's design produced the intended results. The study found that prior to launching the campaign, the CRA conducted and incorporated the recommendations stemming from a study of the campaign's target group and proposed themes. Many studies identify pretesting of campaign themes and study of target audience as a “critical success factor for media campaigns”Footnote 38. Other studiesFootnote 39 also recommend the use of mixed-media strategies in advertising campaigns, as it is more effective than using a single media to deliver a particular message and to reach a target audience. As previously noted, the Agency's campaign included a mixed-media strategy. Furthermore, the media selected for the Agency's campaign have proven to be effective in raising awareness among the intended target audience in other campaigns.

4.2.5 Contribution to the Disruption of Organized Crime Groups

As previously identified, there are numerous initiatives and law enforcement agencies that are active in the Cornwall area to combat contraband tobacco and/or organized criminal activities. As an example, interviewees noted the work of the Cornwall Regional Task Force, the Ontario Organized Crime Enforcement Bureau, and activities under the Contraband Tobacco Enforcement Strategy. Therefore, it is difficult to attribute the disruption of organized crime groups in the area solely to the MACT. Having said this, there are indications that the MACT had made some direct contributions in disrupting organized crime groups.

To assess the extent to which the MACT contributed to the disruption of organized crime groups involved in contraband tobacco, the evaluation examined the activities of the Contraband Tobacco Team as well as the prosecutions related to the Team's investigations. Specifically, the evaluation focused on results related to the number of organized crime groups disrupted, arrests, charges laid and prosecuted, and prosecution outcomes. Lastly, the evaluation examined the contribution of the MACT in seizing contraband tobacco in the Cornwall and Valleyfield areas. All these elements can be considered as contributing to the disruption of the structure and activities of organized crime groups.

Based on program data, the evaluation found that the Team's activities disrupted a total of five organized crime groups during the first two years after the MACT was implemented. During the first six months of 2012-2013, an additional three organized crime groups were disrupted. Only one organized crime group had been disrupted (by the Cornwall's Combined Forces Special Enforcement Unit) in the two years prior to the MACT. Interviewees echoed this finding and noted that some organized crime groups had changed their organizational structure, operating practice, and location (i.e. some groups may have shifted their operations to other locations, for example Valleyfield) as a result of enforcement efforts. They also noted that other initiatives were contributing to the disruption of these groups.

Project O-Stone was identified as a key investigation and considered as having significantly disrupted organized crime in the area.

Project O-Stone was a Contraband Tobacco Team-led investigation launched in 2011. It was initially focused on a group allegedly involved in the smuggling of contraband tobacco. As the investigation evolved, police uncovered that other individuals were also involved in trafficking marihuana and firearms and in other criminal activities. Throughout this twelve-month investigation, police from Canada and the U.S. worked on both sides of the border to gather evidence into the alleged illegal activities of this group. As a result of this investigation, 12 people from Cornwall and the Akwesasne Mohawk Territory are facing 83 charges such as participation in a criminal organization, possession of proceeds of crime, as well as offences related to the smuggling of contraband tobacco and trafficking of marihuana and firearms. In addition to these charges, the Ontario Ministry of Finance has laid an additional 115 charges under the Ontario Tobacco Tax Act. Amongst the items seized during the course of the investigations were: 401 casesFootnote 40 of contraband tobacco products and 11 pounds of cannabis marijuana.Footnote 41

Including Project O-Stone, 20 investigations that were led by the Contraband Tobacco Team resulted in the arrest of 33 individuals. The Team also supported investigations led by other law enforcement agencies, for example Project Cinderford, which was led by the Ontario Provincial Police's Organized Crime Enforcement Bureau. In total, the PPSC has begun the prosecution of over 250 charges resulting from both the investigations led by the Contraband Tobacco Team (such as Project O-Stone) or supported by the Contraband Tobacco Team (such as Project Cinderford). So far, 75% of these charges (i.e. 190) have not yet seen an outcome. Therefore, the full range of outcomes stemming from the MACT investigations and prosecutions will only be known in the coming years.

Despite this, approximately one-third (20 out of 61) of the charges that have been prosecuted to date have resulted in guilty pleasFootnote 42. Some of these guilty pleas were in connection with contraband tobacco illegal activities, while the majority of pleas were related to other illegal activities, i.e. trafficking of cocaine, weapons or marihuana. This illustrates that the MACT not only contributed to the disruption of organized crime groups involved in contraband tobacco activities, but also extended to the combat of other illegal activities. In fact, approximately 40% of all the charges to be prosecuted by the PPSC are in connection with contraband tobacco activities, while approximately 45% involve other illegal activities (e.g. possession or trafficking of illegal drugs or weapons, proceeds of crime). This also shows that “once networks and routes are established, across the border and on land, they are used to smuggle any illegal commodity, beyond contraband tobacco”Footnote 43.

The evaluation also found that the Team's investigations resulted, in some cases, in “criminal organization” chargesFootnote 44 under the Criminal Code. “It is often difficult to justify laying Criminal Code criminal organization charges…due to the complexity that such charges bring to the prosecution”Footnote 45. This illustrates the complexity of organized crime investigations and prosecutions, such as those undertaken by the Contraband Tobacco Team and the PPSC, and the level of investigative and prosecutorial resources required to undertake them.

Law enforcement personnel commented that the MACT allowed the Team to conduct longer-term investigations that are more sophisticated and have a potentially higher impact (i.e. targeting higher-level individuals or organizations) than previous investigations. They also felt it was important to build on the momentum of the investigations that had been created by the Team beyond the existence of the MACT. They mentioned that team members would also be able to build on the expertise that was gained and the partnerships that had been created. This aligns with the Government's recently announced Anti-Contraband Tobacco Force. This new initiative, totaling 50 resources, is expected to build on the work of the Contraband Tobacco Team on organized crime contraband tobacco investigations in the Cornwall area.Footnote 46

The evaluation also examined whether the MACT had contributed to contraband tobacco seizures in the Cornwall area. Given the absence of seizure statistics specifically related to the Contraband Tobacco Team, the evaluation examined the number of seizures for the entire Cornwall detachment. It also examined seizure statistics for the Valleyfield detachment given the close proximity between these two locations.

When examining the number of seizures in these two detachments (individually or together) and comparing them with the national total of seizures by the RCMP, the evaluation found that the proportion of seizures in these detachments to the national total increased following the implementation of the MACT. In 2008-2009 and 2009-2010, carton seizures in Cornwall added up to 33% of the national total compared to 38% in 2010-2011 and 2011-2012. The proportion of fine-cut tobacco seizures in the Cornwall detachment also increased from 19% to 27% of the national total. When combining the seizures from the Cornwall and Valleyfield detachments, the percentage of carton seizures went from 49% between 2008-2009 and 2009-2010 to 65% between 2010-2011 and 2011-2012. Fine-cut tobacco seizures went from 51% to 66% over that same period. This suggests that the MACT along with other initiatives contributed to the increase of contraband tobacco seizures.

Finally, as a lesson learned, interviewees noted that future contraband tobacco initiatives should take into account the full spectrum of the contraband tobacco issues (e.g. other locations, pre-cursors of tobacco manufacturing). This was also reflected in the newly announced Anti-Contraband Tobacco Force initiative, which will include a focus on other locations (e.g. Valleyfield) and tobacco growers and manufacturers.

4.2.6 Contribution to Reduced Availability and Demand for Contraband Tobacco

In order to determine whether the MACT contributed to the reduced availability and demand for contraband tobacco, the evaluation examined data from the RCMP on the price of illegal cigarettes in the Cornwall and surrounding area and data on the legal sales of cigarettes in Canada. In addition, the evaluation conducted interviews with key stakeholders to obtain their perceptions.

Based on interviewee perceptions, demand for contraband tobacco seems to have remained stable in the Cornwall area since the MACT was implemented. Interviewees explained that the demand for contraband tobacco products is linked to legitimate cigarette prices, including taxes, and believed that demand for contraband tobacco will persist as long as contraband tobacco is cheaper.

However, interviewees indicated that the MACT had an impact on reducing the availability (or the supply) of contraband tobacco products. Though not conclusive, this is consistent with data obtained from the RCMP on the price of illegal cigarettes in the Cornwall and surrounding area. In the two years prior to the MACT, the price of contraband cigarettes in the area varied between $195 and $220 per case (one case equals to 50 cartons; one carton equals to 200 cigarettes). Since 2010, the price has fluctuated but is generally higher than in the two years prior to the MACT, reaching a high of $350 in 2010-2011. Prices in 2011-2012 varied between $200 and $310.Footnote 47 As previously mentioned, given the number of contraband tobacco initiatives and law enforcement organizations that are active in the Cornwall area, this change cannot be solely attributed to the MACT, but can be seen as contributing to the overall efforts.

Various industry estimates indicate that legal sales of cigarettes have increased between 2010 and 2012 in Canada.Footnote 48 This increase in legal sales of cigarettes suggests a reduction of sales of illegal cigarettes because both the smoking prevalence rate and the Canadian population growth rate have been stable in recent years. Given that Cornwall and Valleyfield are areas with high levels of contraband tobacco activity, it can reasonably be assumed that the MACT would have contributed to this reduction; however, the evaluation cannot establish to what extent to attribute this result.

4.3 Performance - Efficiency and Economy

The following section presents the MACT allocation and cost figures. It also assesses, based on available information, the cost efficiency (i.e. outputs are produced at minimum cost) and/or economy (i.e. lowest cost to achieve expected outcomes) of each MACT measure. Detailed financial figures are provided in Annex C.

4.3.1 Allocation and Cost to Organizations

The funding instrument was approved in the fall of 2010, consequently participating departments and agencies received their allocations in the third quarter of 2010-2011.

Royal Canadian Mounted Police

The RCMP was allocated $7.41 million for the three years. The allocation was not broken down between the Contraband Tobacco Team and Community Outreach activities which were delivered by the same unit. Direct program spendingFootnote 49 for the two activities were not tracked separately. Table 2 presents the RCMP allocation and the cost to the RCMP to deliver the MACT activities.

| 2010-2011 | 2011-2012 | 2012-2013 | |

|---|---|---|---|

| Allocation ($) | 2,660,000 | 2,450,000 | 2,300,000 |

| Direct Program Spending ($) | 582,600 | 1,964,700 | 2,093,400 |

| Cost to RCMP ($)1 | 765,500 | 2,617,300 | 2,811,600 |

| Cost to RCMP / Allocation | 29% | 107% | 122% |

Note:

- Cost to RCMP includes direct program spending, internal services, and employee benefits plan and it does not include PWGSC accommodation allowance. It does not include the provision for supervision, management and oversight beyond the unit or division. Refer to Annex C for the full breakdown.

As shown in the table, the RCMP under-expended in the first year. The RCMP commented that there were challenges to achieving full operating capacity, particularly in recruitment. In April 2010, the number of FTEs at the Contraband Tobacco Team was four and steadily increased to a full complement of 12 by April 2012. During 2011-2012 and 2012-2013, the RCMP demonstrated its support for the MACT activities by reallocating additional funds to the initiatives from its own base. This translated to an investment of 7% more and 22% more than the allocation from its own base.

Public Prosecution Service of Canada

| 2010-2011 | 2011-2012 | 2012-2013 | |

|---|---|---|---|

| Allocation ($) | 180,900 | 361,800 | 352,000 |

| Direct Program Spending ($) | 80,400 | 271,600 | 197,700 |

| Cost to PPSC ($)1 | 101,400 | 342,500 | 249,300 |

| Cost to PPSC / Allocation | 56% | 95% | n/a |

Note:

- Cost to PPSC includes direct program spending, internal services (4% of salary and operations and maintenance, compared to 25% or 40% for other MACT partners), employee benefits plan, and other MACT-related activities. It does not include PWGSC accommodation allowance. Refer to Annex C for the full breakdown.

Table 3 presents the PPSC allocation and the cost to the PPSC to deliver the MACT activities. Since demand for PPSC's legal advice and prosecution service was driven by the needs of RCMP investigators, it is reasonable that PPSC spending followed a similar trend as that of the RCMP. Figures for direct program spending and cost to PPSC for 2012-2013 are from April 1, 2012 to September 30, 2012. As with the RCMP, we expect that the PPSC will invest from its own base in 2012-2013.

Canada Border Services Agency

The CBSA was allocated a total of $3.480 million over the three-year MACT period.Footnote 50 Internally, the CBSA allocated $832,500 to the Contraband Tobacco Detector Dog Service and $2,248,700 to the Laboratory for a total of $3.081 million over the three-year period. Using the difference between the Agency's allocation and the CBSA internal allocation for the two initiatives, figures in Tables 4a and 4b present the CBSA estimated allocation from the federal government for each of the CBSA MACT initiatives.

| 2010-2011 | 2011-2012 | 2012-2013 | |

|---|---|---|---|

| Estimated allocation1 | 254,900 | 340,950 | 340,950 |

| Direct Program Spending ($) | 103,300 | 248,600 | 242,500 |

| Cost to CBSA ($)2 | 173,000 | 386,300 | 373,900 |

| Cost to CBSA / Estimated Allocation | 68% | 113% | 110% |

| 2010-2011 | 2011-2012 | 2012-2013 | |

|---|---|---|---|

| Estimated allocation1 | 1,293,900 | 654,000 | 585,500 |

| Direct Program Spending ($) | 1,008,800 | 465,700 | 420,900 |

| Cost to CBSA ($)2 | 1,187,600 | 698,500 | 645,500 |

| Cost to CBSA / Estimated Allocation | 92% | 107% | 110% |

Note for Tables 4a and 4b:

- Estimated allocation represents the estimated amount that the federal government provided to each of the CBSA MACT initiatives.

- Cost to CBSA includes direct program spending, internal services, and employee benefits plan and it does not include PWGSC accommodation allowance. It does not include other MACT activities performed by program staff and executives that were not funded under the MACT. Refer to Annex C for the full breakdown.

As shown in the tables, considering the Agency received the allocation late during the first year, the Agency was still able to expend 68% and 92% of its estimated allocation for the Contraband Tobacco Detector Dog Service and the Laboratory respectively. During 2011-2012 and 2012-2013, the Agency demonstrated its support for the MACT activities by reallocating additional funds to the initiatives from its own base. This translated to an investment of 13% and 10% more than the estimated allocation from its own base in 2011-2012 and 2012-2013 to support the activities of the Contraband Tobacco Detector Dog Service. The Agency also invested 7% and 10% more than the estimated allotment for laboratory activities in 2011-2012 and 2012-2013. In total, the cost to the CBSA to deliver the two initiatives over the three years was $3.465 million, within $6000 of the Agency's allocation.

Canada Revenue Agency

| 2010-2011 | 2011-2012 | 2012-2013 | |

|---|---|---|---|

| Allocation ($) | 4,970,000 | n/a | n/a |

| Direct Program Spending ($)1 | 1,475,000 | n/a | n/a |

| Cost to CRA ($)2 | 1,981,100 | n/a | n/a |

| Cost to CRA / Allocation | 40% | n/a | n/a |

Note:

- This amount is the direct program spending for fees (e.g. the ad agency) and paid media only as reported in the Government of Canada advertising reporting tool (AdMIS). It does not include research costs and other fees (e.g., proprietary Agency of Record fees, PWGSC service fees, travel, translation, etc.)

- Cost to CRA includes direct program spending, internal services, employee benefits plan, and other MACT-related activities (e.g. time spent by marketing and research teams). It does not include PWGSC accommodation allowance. Refer to Annex C for the full breakdown.

Table 5 presents the CRA allocation and the cost to the CRA to deliver the MACT activities. The CRA received an allocation for 2010-2011 only. The Agency explained that due to the complexities of the economic and social environment during the planning phase, in consultation with senior decision-makers at the CRA and at Central Agencies, a low-key approach was used to communicate the message. This approach resulted in the CRA spending 60% less on the campaign than originally conceptualized.

Public Safety Canada

| 2010-2011 | 2011-2012 | 2012-2013 | |

|---|---|---|---|

| Allocation ($) | 0 | 0 | 160,000 |

| Direct Program Spending ($) | 0 | 0 | 160,000 |

| Cost to PS ($)2 | 5,500 | 29,100 | 226,8001 |

| Cost to PS / Allocation | n/a | n/a | n/a |

Note:

- Figure for cost to PS for 2012-2013 is from April 1, 2012 to September 30, 2012. Figures for allocation and direct program spending are for the full fiscal year in 2012-2013, for the conduct of this evaluation.

- Cost to PS includes direct program spending, internal services, employee benefits plan, and other MACT-related activities. It does not include PWGSC accommodation allowance. Refer to Annex C for the full breakdown.

Table 6 presents the PS allocation and the cost to the PS to deliver the MACT activities. Except for the conduct of this evaluation in 2012-2013, PS was not allocated funding to support MACT-related activities (e.g., development of the Performance Measurement Strategy, bilateral discussions between PS and partners on activity updates, ongoing policy analysis of anti-contraband enforcement measures). The allocation to conduct this evaluation is assumed to be fully spent.

4.3.2 Contraband Tobacco Team

Though the core mandate of the Contraband Tobacco Team is to focus on the investigation of organized crime involved in contraband tobacco activities, the outcomes of these investigations are not easily quantifiable. Given the Team also contributed to the seizure of contraband tobacco in the Cornwall area, the evaluation team used seizure-related data combined with costing information for the first two years of the MACT to approximate the “break-even” point for the federal investment related to the Contraband Tobacco Team.

This analysis was conducted under the assumption that seizures represent a reduction of availability of the illegal supply to consumers. If these consumers were to obtain the cigarettes from legal sources, the federal government could have collected taxes from them. In order to approximate a “break-even” point, the analysis equated the total potential gain in federal tax revenue from seizuresFootnote 51 to the cost of having the Team. The break-even point did not factor other societal benefits attributable to the reduction in illegal supply like the reduction of health harm to citizens, and seizures of other proceeds of crime such as cash, drugs and firearms. The break-even point was calculated as follows:

Break-even point or # seizures (cartons)Footnote 52 = Federal cost of the Team / (divided by)

Potential gain in Federal tax revenue/seized cartonFootnote 53

Recognizing that seizures only represent one aspect of the Team's work, this analysis used the estimated cost to the federal government of all the activities of the Team (including investigating organized criminal activities related to contraband tobacco). By doing so, the cost of the Team to conduct seizure activities was overestimated in the analysis, but this assisted in approximating the break-even point.

With this exercise, the evaluation found that the seizure of about 84,000 cartons per year or 35% of the 238,000 cartons seized in the Cornwall area would have to be attributable to the Team's work to “break-even”.

Due to the roll-up of seizure statistics at the Divisional level (Cornwall Detachment), it is not possible to attribute seizures to a particular initiative. Program representatives indicated that the Team represented, during these years, between 10% and 30% of the investigative resources in the Cornwall area.Footnote 54 Since seizures only represent a portion of the Team's efforts, and the recuperation of tax revenues only one aspect of the benefits, it is more than probable that the federal investment on the Team is positive if all benefits could be brought into the calculation.

4.3.3 Tobacco Origin Analysis and Contraband Tobacco Detector Dog Service

Contraband Tobacco Detector Dog Service

This sub-section examines the efficiency and economy of the CBSA Contraband Tobacco Detector Dog Service by using information provided by the program representatives.

The two dog teams required approximately two years to be functioning effectively. Thus, the following cost analysis illustrates only a short-term transitory snapshot and is not indicative of what would have happened if the CBSA Contraband Tobacco Detector Dog Service were to continue beyond the three-year MACT period.

During the MACT period, the two dog teams were increasingly more cost-efficient in conducting searches. The evidence shows that the number of searches progressively increased during the last two years of the MACT and the cost of a dog team stayed relatively constant (about $99,000 per team per year). It is also noted that the cost of having the contraband tobacco detector dog teams was comparable to other detector dog teams that pre-existed the MACT.Footnote 55

Establishing the value and the cost-effectiveness of the Contraband Tobacco Detector Dog Service is complex and can involve many factors. These factors may include the contribution of the dog teams to other drug and firearm enforcement actions; the reduction in the time border services officers spend on searching for incoming contraband, thereby allowing officers to increase their focus on other high-risk goods. In general, the use of detector dog teams is a complement to the other detection technologies that the CBSA uses to combat border criminality. Often, detector dog teams are less costly to maintain and they are more efficient in their searches.

Considering all these other factors, the number and the volume of contraband tobacco seizures represent only one aspect to assess the cost-effectiveness of the detector dog teams. Under the MACT, the value of seizures made by each dog team represented about $350 in lost federal taxes per year.Footnote 56 Based on seizure results, the contraband tobacco detector dog teams were not found to be cost-effective.

TOBACCO ORIGIN ANALYSIS – SCIENCE AND ENGINEERING DIRECTORATE

The laboratory conducted a scientific research project, focused on developing scientific capabilities to determine the origin of tobacco to support investigative efforts. Given the nature of scientific research, [ * ].

[ * ]. The cost to the federal government per sample analyzed is about $1,200 over the three-year MACT period. This included the costs of the foundational work mentioned above. [ * ].

4.3.4 Other MACT Measures

The evaluation team attempted to identify a meaningful quantifiable measure to assess the efficiency of PPSC activities in support of MACT objectives. Initially, it appeared that efficiency could be measured by the cost of legal advice and prosecution services. However, the demand for and nature of such activities are driven by the needs of investigators, the nature of the investigations and resulting charges. The greater the file complexity, the greater the need for more experienced prosecutors and amount of time required. Thus, the total cost of the legal advice and prosecution services provided by the PPSC is not entirely under its control.

PPSC program representatives indicated that the PPSC has implemented a case management model, which is intended to maximize its effectiveness and efficiency by aligning the nature and complexity of files to the competencies and experiences of legal practitioners. In addition, the PPSC has adopteda major case management protocol to ensure better pre-charge preparation and more manageable prosecutions of major crimes.